Bush-era tax cuts for upper-income taxpayers while retaining them for middle- and lower-income people. That law, part of the congressional deal that resolved the 2012-13 “ fiscal cliff,” undid many of the George W. Effective rates on those same groups rose sharply, however, following enactment of the American Taxpayer Relief Act of 2012. Generally speaking, effective tax rates fell across the board throughout most of the 2000s, though the highest-income tiers experienced the steepest drops. On average, taxpayers making less than $30,000 paid an effective rate of 4.9% in 2015, compared with 9.2% for those making between $50,000 and under $100,000 and 27.5% for those with incomes of $2 million or more.īut the system starts to lose its progressivity at the very highest levels: In 2015, the effective rate peaked at 29.3% for taxpayers in the $2 million-to-under-$5 million group, then fell to 28.8% for the $5 million-to-under-$10 million group and 25.9% for those making $10 million or more.

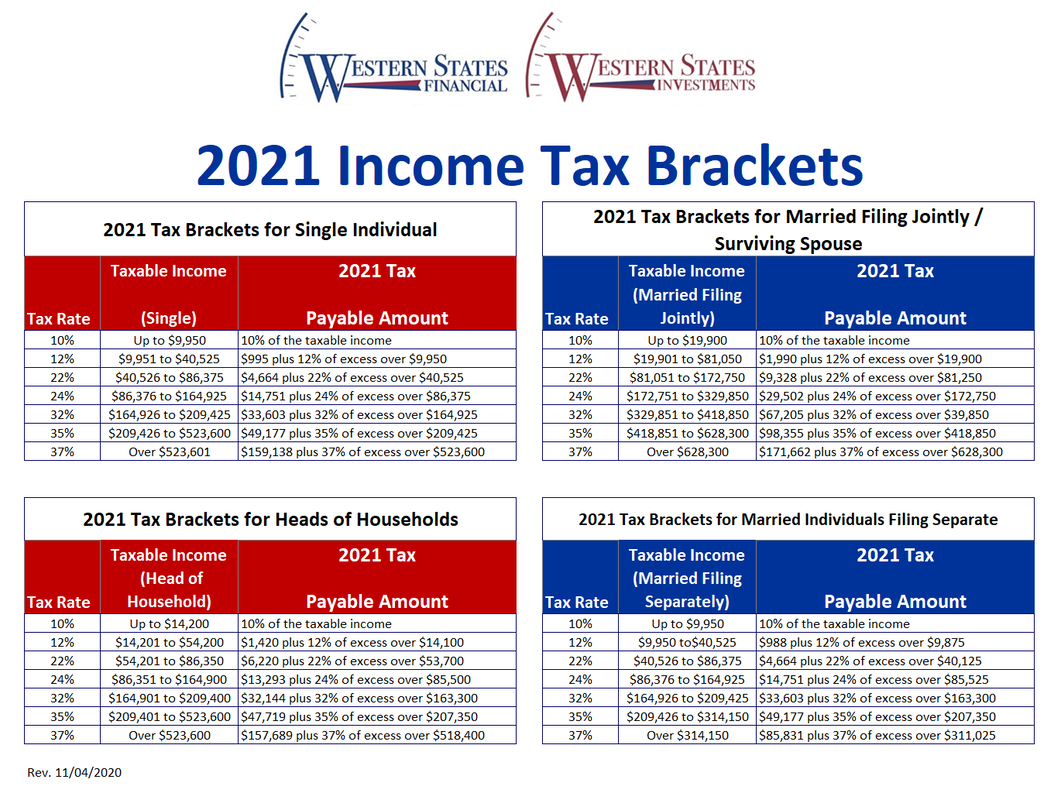

Some of those shifts may be due to changes in the tax laws or to what’s known as “bracket creep” – the phenomenon in which inflation pushes people into higher tax brackets.Įffective tax rates – calculated as the total income tax owed divided by adjusted gross income – also rise with income. For example, the $2 million-and-higher group paid 20.4% of all tax in 2015, up from 17.2% in 2000. Nearly all income tiers above $100,000 paid higher shares of total income tax in 2015 than they did in 2000 (though the shares for many high-income groups fell in the early 2000s, following enactment of major tax cuts in 20). (The IRS tax data used here are estimates based on a stratified probability sample of all returns.) A Pew Research Center analysis of IRS data from 2015, the most recent available, shows that taxpayers with incomes of $200,000 or more paid well over half (58.8%) of federal income taxes, though they accounted for only 4.5% of all returns filed (6.8% of all taxable returns).īy contrast, taxpayers with incomes below $30,000 filed nearly 44% of all returns but paid just 1.4% of all federal income tax – in fact, two-thirds of the nearly 66 million returns filed by people in that lowest income tier owed no tax at all. The individual income tax is designed to be progressive – those with higher incomes pay at higher rates. Spending that’s not covered by taxes is paid for by borrowing. The rest of the federal government’s revenue comes from a mix of sources, including Social Security and Medicare payroll taxes, excise taxes such as those on alcohol and gasoline, unemployment-insurance taxes, customs duties and estate taxes. The corporate income tax was estimated to raise another $324 billion, or 9% of total federal revenue. 30, the individual income tax was expected to bring in nearly $1.66 trillion, or about 48% of all federal revenues, according to the Office of Management and Budget.

Individual income taxes are the federal government’s single biggest revenue source.

tax code, it’s helpful to take a closer look at how the tax system works presently in the context of its recent history. Note: For an April 2023 look at who pays income tax, read “Who pays, and doesn’t pay, federal income taxes in the U.S.?”Īs Congress and the White House pivot from trying to repeal the Affordable Care Act to overhauling the U.S.

0 kommentar(er)

0 kommentar(er)